2023: INCOME IS BACK- One (maybe the only?) Positive From the Pain of 2022

Fixed Income investors finally had the year many were predicting over the last decade, ending eight consecutive years of positive total returns for the broad municipal bond market. Much like the proverbial broken clock, if one keeps consistently predicting doom they will eventually get it right. Inflation rose quickly and persisted stubbornly. This forced the Fed to raise rates, triggering fear in the fixed income market. Muni bond investors fled the market to the historic tune of over $120 billion in net outflows. For perspective, the second worst outflow year in the 100-plus year history of the municipal bond market was 2013 at $72 billion.

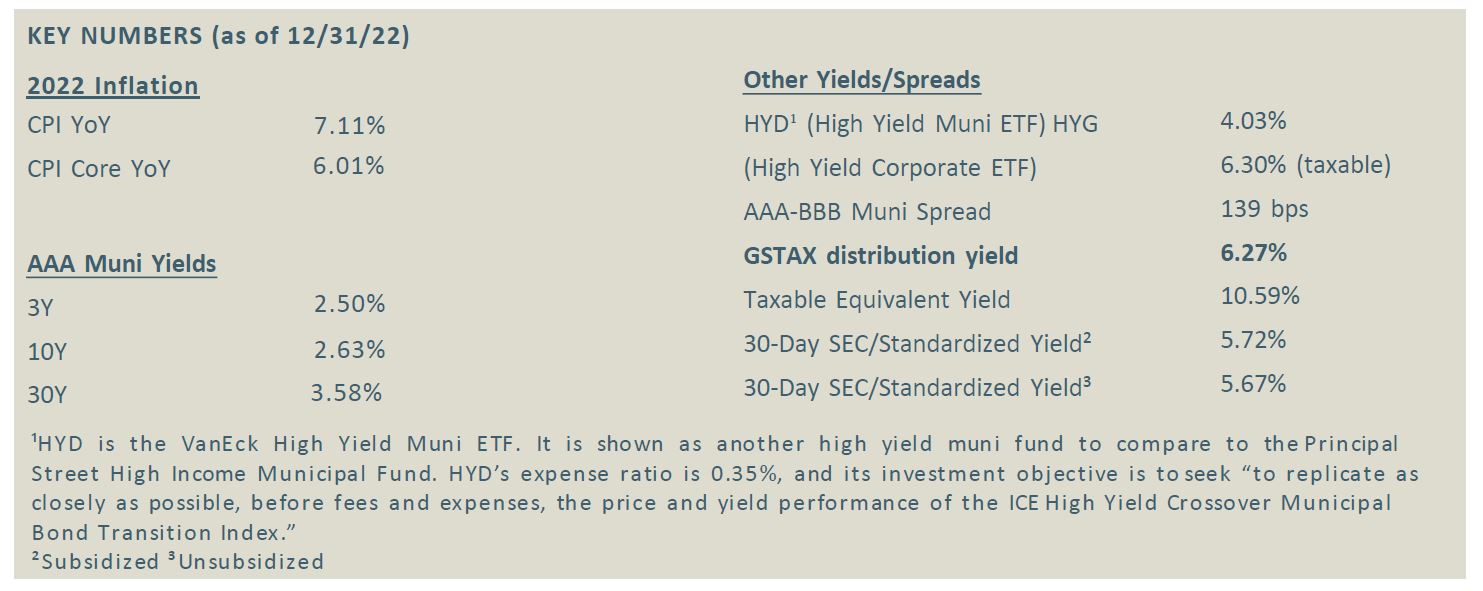

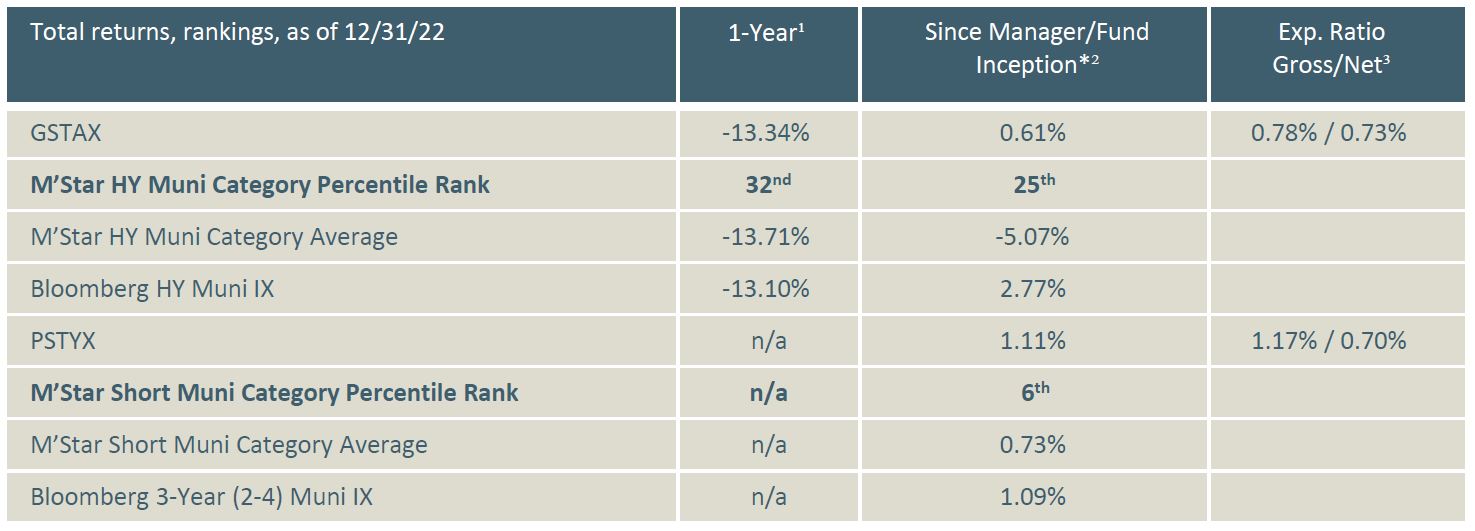

We here at Principal Street focused on riding through the volatility, taking advantage of the trading opportunities presented, continuing to diversify, and building a solid tax free income stream for our investors. Our True High Yield Fund, the Principal Street High Income Municipal Fund (GSTAX), rode out the storm – putting up 2nd quartile performance while maintaining the highest yield in the high yield category. We also started a short term, high grade fund, the Principal Street Short Term Municipal Fund (PSTYX), in April of 2022, which offered the highest yield in the short term category. Our timing was serendipitous as our unique strategy is well suited to take advantage of the income opportunities now available in the short end of the yield curve. This is an environment that has not existed for several years and we are excited to provide meaningful income while limiting volatility for our investors.

Municipal Bond Technicals Strongest In Some Time

YIELD – The most obvious technical improvement – yield – increased throughout 2022. Investors are now being compensated much more to take risk. Many income-oriented investors have been on the sidelines foraging for alternative forms of income in structured assets, private equity, real estate, etc. We expect many of these investors will likely take a closer look at munis now that yields have increased.

OUTFLOWS – The municipal bond market suffered relentless outflows – 49 out of 52 weeks – in 2022. Outflows in 2022 set new records for number of weeks and, as we mentioned above, absolute dollar amount. This powerful technical force tends to have a disparate impact to pricing in the high yield market, explaining the sector’s underperformance versus the broader municipal bond market. This imbalance between supply and demand drove prices lower, in many cases indiscriminately and regardless of intrinsic or relative valuations. There have not been consecutive years of net market outflows in munis in the last 30 years. We have observed over our long careers that the repricing and yield adjustment to high yield munis tends to bring investors back.

ISSUANCE – Total issuance in the municipal market has been muted for several years as the bailout packages reduced the need for states and municipalities to borrow. Issuance declined by 20% in 2022 alone. There has been an even larger percentage decline in the high yield sector of the market over the last few years. The lack of new supply should help the performance of high yield muni bonds as supplies continue to wane – especially if outflows reverse.

STRUCTURAL IMPROVEMENTS – A less obvious improvement to market outsiders. With demand weak, the new issuance side of the muni market also tightened up its covenants, meaning issuers had to improve deal quality in order to borrow money. More equity, better bond structures and improved investor protections, as well as pledged collateral were necessary to get deals done. The days of easy money are fading which is a good thing for investors.

CREDIT QUALITY – Default rates remain low. Even during the pandemic, personal income, property and sales tax revenues all performed well, exceeding expectations in most cities, counties and states. All while Federal stimulus money and internet sales tax revenues added billions to municipal coffers. State revenues surpassed the previous peak and many states once again amassed reserve balances that eclipsed the record levels set in 2019. Most muni credits tend to be less sensitive to the general economic cycle and are well-positioned for an economic downturn, at least a moderate one. There is certainly some risk of a severe downtown that could cause issues in certain sectors of the market, but we believe those to be limited in scale and scope. We have been thinking through such scenarios as we evaluate adding credits and diversifying the portfolio seeking defensive and resilient credits and bond structures.

Performance

GSTAX started 2022 in a more defensive orientation and did not see outflows to the same degree as many of our peers. This contributed to our advantage and provided an ability to be selectively opportunistic throughout the year. Second quartile performance for GSTAX in the high yield fund category was an acceptable relative performance result for us. Rarely does the category leader in yield capture 2nd quartile results in off markets, reflecting our nimbleness and consistent investment process. As mentioned above, we launched the short fund, PSTYX, in April 2022. This fund is designed to offer a complement to the high yield fund, GSTAX. It seeks to offer attractive tax free yield, with less price volatility, relative to its peer group. In support of that, we built in a host of risk controls such as a maximum 3-year average effective maturity, and 90% investment grade bogeys. To our management style, 2022 was an advantageous year to build the foundation of this fund’s portfolio.

Conclusion

Year-end pieces and predictions are fraught with peril. You may notice a consistent thread in our marketing and presentations. The words “income” and “yield” are omnipresent. This is true in our marketing because it is true in our management whether we are focused on the high yield part of the market (GSTAX) or the short duration, high grade part of the market (PSTYX). We prefer to avoid the hazard of rate predictions and maintain our focus on income, credit quality, and structure. We sincerely appreciate the opportunity to manage money on behalf of you and your clients.

-The Principal Street Municipal Bond Strategies Team

GSTAX offered a distribution yield of 6.27% tax free (SEC yield 5.67% unsubsidized, 5.72% subsidized) as of 12/31/22.

PSTYX offered a distribution yield of 3.33% tax free (SEC yield 2.67% unsubsidized, 3.13% subsidized) as of 12/31/22.

The performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost, and current performance may be lower or higher than the performance data quoted. Short term performance in particular is not a good indication of these Funds’ future performance, and an investment should not be made solely on returns. For performance current to the most-recent month end, please visit www.principalstreetfunds.com.

*Since manager inception for GSTAX is 3/1/21 is the current management team’s start date on the fund. Prior to 3/1/21, the Fund operated under a different management from its inception date of 9/15/17. PSTYX was incepted on 4/27/22.

The per share income and capital changes for the prior fiscal years of the Fund were disclosed in the Fund’s prospectus. Performance for the periods beginning with Fund inception date through current dates as used above has been dropped for marketing purposes. Average annual total returns for the 3-year and since (Fund) inception periods pre-dating the current management team’s start date are available upon request.

¹Cumulative Total Return

²For GSTAX: average annual total return, for PSTYX: cumulative return

³The contractual Operating Expenses Limitation Agreements are indefinite, but cannot be terminated through at least February 14,

2023 for GSTAX, and April 27, 2023 for PSTYX, respectively. The net expense ratio is applicable to investors.

You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before you invest. This and other important information is contained in the Fund’s summary prospectus and prospectus, which can be obtained by calling 1.877.914.7343 or visiting our website at principalstreetfunds.com. Read carefully before you invest.

Mutual Fund investing involves risk. Principal loss is possible. The Fund’s value investments are subject to the risk that their intrinsic values may not be recognized by the broad market or that their prices may decline. Fixed-income securities are or may be subject to interest rate, credit, liquidity, prepayment and extension risks. Interest rates may go up resulting in a decrease in the value of the fixed-income securities held by the Fund. High-yield fixed income securities or “junk bonds” are fixed-income securities held by the Fund that are rated below investment grade are subject to additional risk factors such as increased possibility of default, illiquidity of the security, and changes in value based on public perception of the issuer. The municipal market is volatile and can be significantly affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal securities. The Fund is new with no operating history ax, legislative or political changes and there can be no assurance that the Fund will grow to or maintain an economically viable size.

Tax Equivalent yield is the interest rate which must be received on a taxable security to provide the bondholder the same after-tax return as that earned on a tax-exempt security. The tax rate used to calculate the Taxable Equivalent Yield is the 37% marginal federal income tax bracket.

Credit Rating: A private independent rating service evaluates a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from “AAA”, which is the highest grade, to “D”, which is the lowest grade. In limited situations when the rating agency has not issued a formal rating, the rating agency will classify the security as non-rated. Weighted Average Maturity is a weighted average of all the maturities of the bonds in a portfolio, computed by weighting each bond’s effective maturity by the market value of the security.

Principal Street Partners, LLC is the Investment Adviser to the Principal Street Partners High Income Municipal Fund, which is distributed by Quasar Distributors, LLC.

Download a PDF of this commentary here.

IMPORTANT DISCLOSURE INFORMATION

This commentary is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. The statements contained herein are based upon the opinions of the Portfolio Management team and the data available at the time of publication of this report. Any sectors or securities mentioned are based on newsworthiness and may or may not reflect holdings in any Principal Street portfolio. The reader should not infer that any securities discussed were or will be profitable. Information was obtained from third party source s believed to be reliable, are not necessarily all inclusive, and are not guaranteed as to accuracy. Past performance is no guarantee of future results and there is no assurance that any predicted results will actually occur.